A Sample income Statement—using the Accrual Method

This example is based on a small organization that buys washing machines directly from the manufacturers, which it then sells online and through a network of retail distributors. Even though this organization has a straightforward business model it provides a good illustration of the issues you will need to consider when interpreting or compiling an income statement.

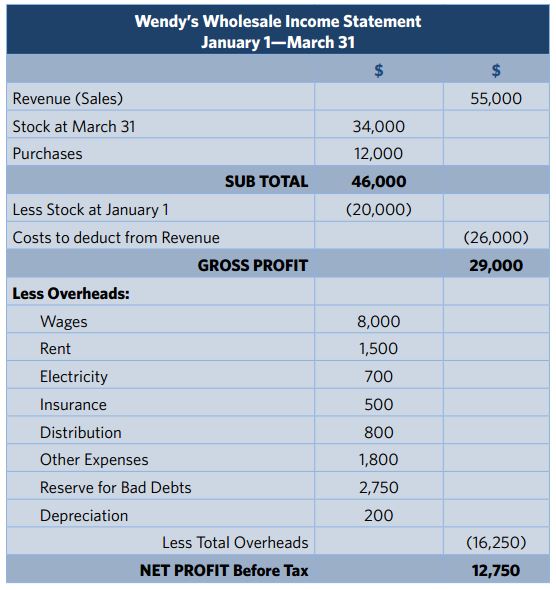

Here is the income statement for ‘Wendy’s Wholesale’ for the frst quarter of the year. The organization uses the accrual method of accounting.

This income statement looks similar to that for Lamichhane Group except that there are some additional entries and considerations.

● Stock

● Gross Proft

● Net Proft

● Accruals (Costs not yet entered)

● Prepayments (Costs entered in advance)

● Bad Debt Reserve

● Depreciation

Each of these items is described below:-

Stock

Wendy’s must hold a stock of washing machines, so that they can be dispatched on the same day as they are ordered. An inaccurate net proft fgure will result if costs include washing machines purchased but still in stock at the end of the period. This is allowed for by counting stock at the beginning and end of the period. Counting stock can be done manually, if little stock is carried, but larger organizations will have these fgures supplied by their computerized stock control system. A physical stock take is usually conducted periodically to avoid discrepancies accumulating and causing problems.

Gross Proft

An organization’s gross proft is calculated by taking away the cost of producing and selling its goods sold from revenues earned.

Net Proft

Net proft or ‘net income’ is calculated by subtracting all other overhead expenses from the gross proft.

Proft Margin

An organization’s proft margin can be expressed as a ratio or by product as a percentage. The ratio is calculated as net profts (or net income) divided by revenue (sales). It measures how much out of every dollar of sales an organization actually keeps in earnings. For Wendy’s this ratio would be:

When referring to the proft margin of an individual product it is the difference between the selling price and the cost price of the product. For example:

This is often expressed as a percentage where the difference between the selling price and the cost price is divided by the selling price. This answer is then multiplied by 100 to become a percentage. For example:

Accruals (Costs not yet entered)

An accrual is an allowance for costs that have not yet been invoiced. For example, Wendy’s have not yet received their electricity bill for this quarter. Since the purpose of the income statement is to present an accurate picture of the fnances for the period it needs to recognize this liability even though no invoice has been received. In this instance Wendy’s would look at last year’s bill for the same period, which was $667, and then enter a fgure of $700 as a realistic estimate for the quarter.

Prepayments (Costs entered in advance)

A prepayment is the opposite of an accrual. Wendy’s received an invoice from its insurers for $2,000 in January, which is their insurance premium for the year. In the income statement they would apportion this invoice into equal amounts for each quarter. So a fgure of $500 is entered this quarter’s expense on the income statement.

Bad Debt Reserve

Even though Wendy’s has a carefully controlled policy of extending credit, sometimes one of its retailers becomes insolvent or bankrupt before the invoice is paid. This creates a ‘bad debt,’ which means that payment will never be collected and so becomes an expense. Technically, a bad debt becomes a bad debt when the chances of payment become so small as to be nonexistent. Many organizations know from experience the sort of percentage of total sales that will never be paid for. In Wendy’s case they estimate a 5% bad debt expense has happened when the sale is made. Even though no check is actually written to cover this percentage, it exists as a total against which the actual bad debt can be subtracted from. The way that bad debt is handled in the accounts is explained more fully in our other chapter.

Depreciation

All organizations have fxed assets such as offce and capital equipment, which have a useful and productive life longer than the period of an annual income statement. Many of these items have a useful life that will span several years. It would be unreasonable to apportion the costs of these to the quarter in which they were purchased. This problem is overcome by charging only a portion of the cost of these assets to each quarter of their expected useful life.

For example, Wendy’s bought a new lorry for $4,000 in January and it has a productive life of five years. This allows for $800 a year ($4,000 divided by 5 years life) in depreciation, which for the quarterly income statement enables $200 to be entered under overheads as depreciation.

KEY POINTS

- An accrual is an allowance for costs that have not yet been invoiced. In other words, a charge incurred in one accounting period that has not been paid by the end of it.

- A prepayment is a payment in advance for a good or service not yet received.

- Many organizations know from experience the sort of percentage of total sales that will never be paid for and make an allowance for this ‘bad debt.’

- Depreciation is a method of allocating the cost of a tangible asset over its useful life.

======================= Thank You ============================

0 comments:

Post a Comment